r&d tax credit calculation example

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Ad Receive you refund via direct deposit.

R D Tax Credit Calculation Examples Mpa

Weve Been In Your Shoes Want To Help.

. Ad Find Visit Today and Find More Results. The RD credit is calculated on the federal income tax return as usual and may be applied against payroll taxes starting the quarter after the credit is elected. Ad In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process.

If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. There are two ways to calculate the RD tax credit. Dont Leave Your RD Tax Credit On The Table.

70000 - 24167 45833 x 14. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. Dont Leave Your RD Tax Credit On The Table. Weve Been In Your Shoes Want To Help.

Multiply average QREs for that three year period by 50. This credit appears in the Internal Revenue Code section 41 and is. Over 85 million taxes filed with TaxAct.

Ad In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process. Multiplied by 14 equals credit. Regular research creditThe RRC is an incremental credit that equals.

Identify and calculate the companys average qualified research expenses QREs for the prior three years. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. In general the RRC method may be best for taxpayers with low base amounts or for new startups.

Estimate Your Savings Now. Find Out More With Our Free RD Tax Credit Calculator. Ad Use The RD Tax Credit to Offset Payroll or Income Taxes.

Start filing for free online now. Ad File 1040ez Free today for a faster refund. Since the RD tax credit was first introduced in 1981 both Republican and Democratic administrations have revised and.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

R D Tax Credit Calculation Examples Mpa

Grade 6 Lab Report Template 2 Templates Example Templates Example Lab Report Template Report Template Lab Report

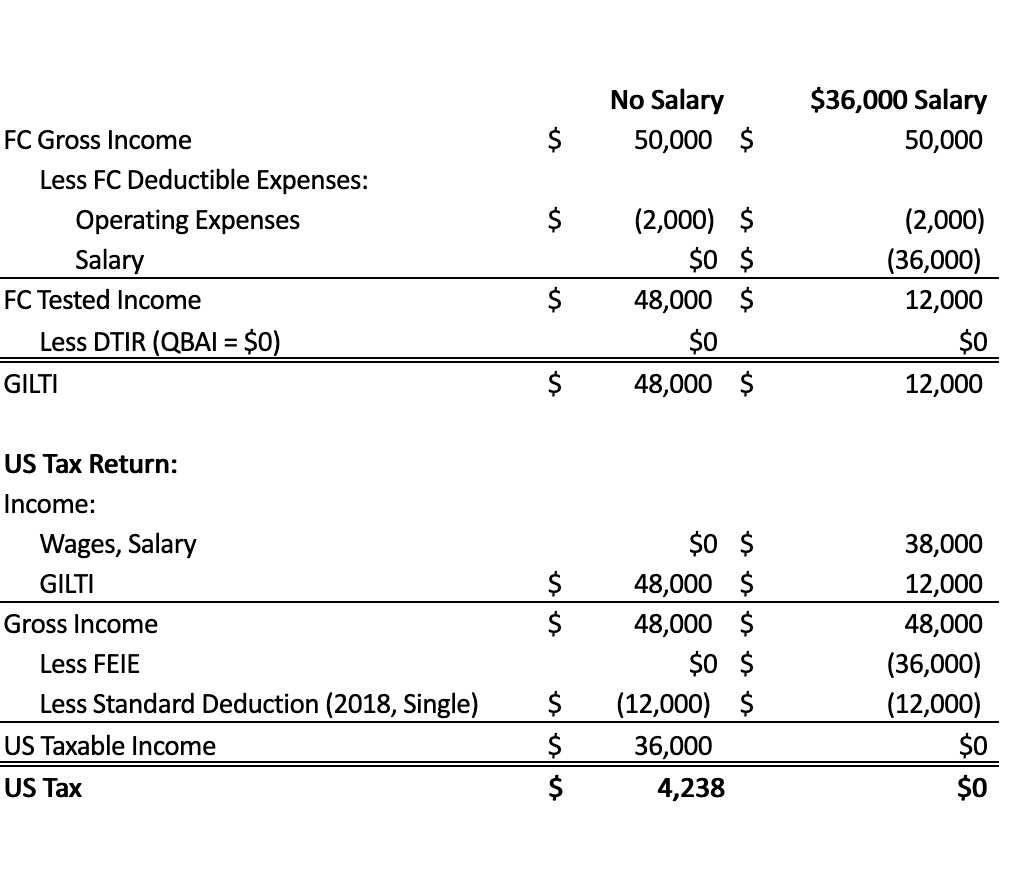

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Pin On Small Business Resources

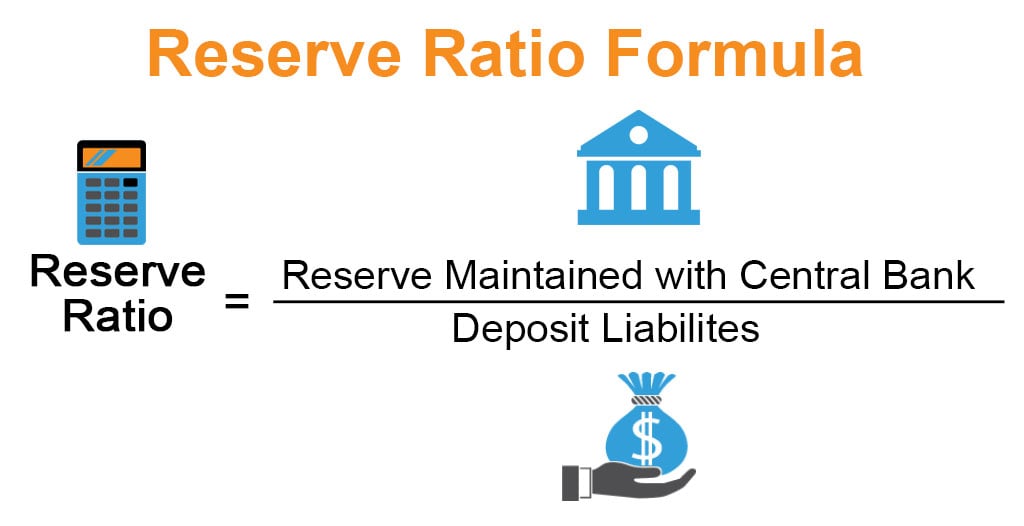

Reserve Ratio Formula Calculator Example With Excel Template

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Methods Adp

Compensation Headcount Variance Report Example Uses

Transfer Price Meaning Importance Example And More Transfer Pricing Accounting And Finance Economics Lessons

R D Tax Credit Calculation Methods Adp

:max_bytes(150000):strip_icc()/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)

Dupont Analysis Definition Formula Equation

How Much Do You Need To Invest To Get Dividend Income Save Spend Splurge Dividend Income Investing Dividend Investing

Wacc Weighted Average Cost Of Capital In 60 Seconds Go Ahead And Repin Cost Of Capital Cost Accounting Weighted Average

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

Free Personal Financial Plan Template Financial Plan Template Financial Planning Business Plan Template

Incentive Plan Template Beautiful Employee Bonus Plan Template Uk Templates Resume Incentives For Employees Incentive Programs How To Plan

Blank Accounting Ledger Template Printable Journal Template Printable Worksheets Template Printable

Transfer Price Meaning Importance Example And More Transfer Pricing Accounting And Finance Economics Lessons